10 Common Mortgage Mistakes to Avoid When Buying Your First Home

Calculate Your Mortgage Now

Get instant estimates for your monthly payments

Introduction

Buying your first home is one of the biggest milestones in life. But the process can be confusing, especially when it comes to mortgages. Many first-time buyers in the USA make avoidable mistakes that cost them thousands of dollars—or even prevent them from securing the home they want.

This guide highlights the 10 most common mortgage mistakes and how you can avoid them, so you can move into your dream home with confidence.

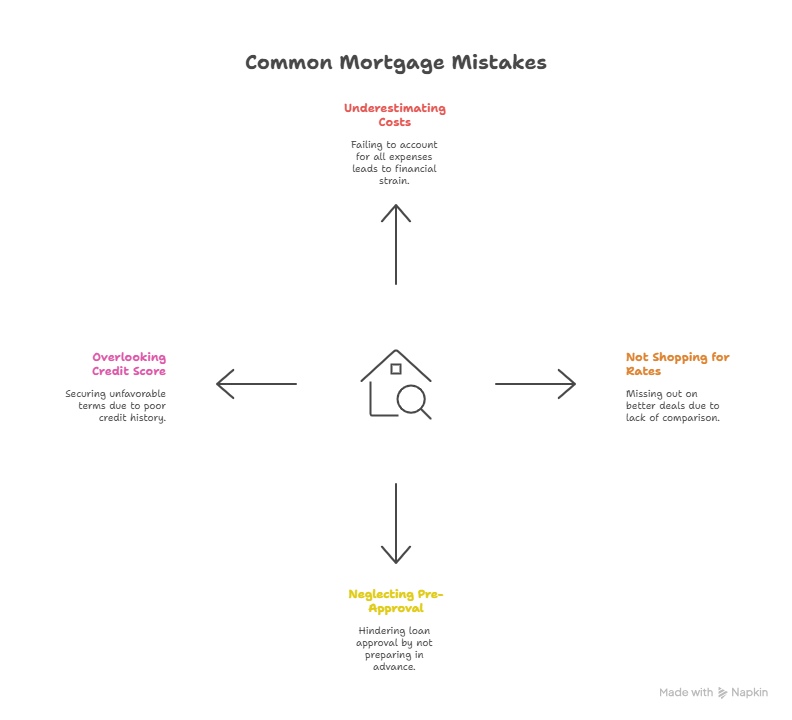

1. Not Checking Your Credit Score Early

Your credit score plays a huge role in determining your mortgage approval and interest rate.

- Mistake: Waiting until the last minute to check credit.

- Solution: Check your score at least 6 months before applying. If needed, improve it by paying down debt and making on-time payments.

👉 Learn more in our blog on improving your credit score before applying for a mortgage

.

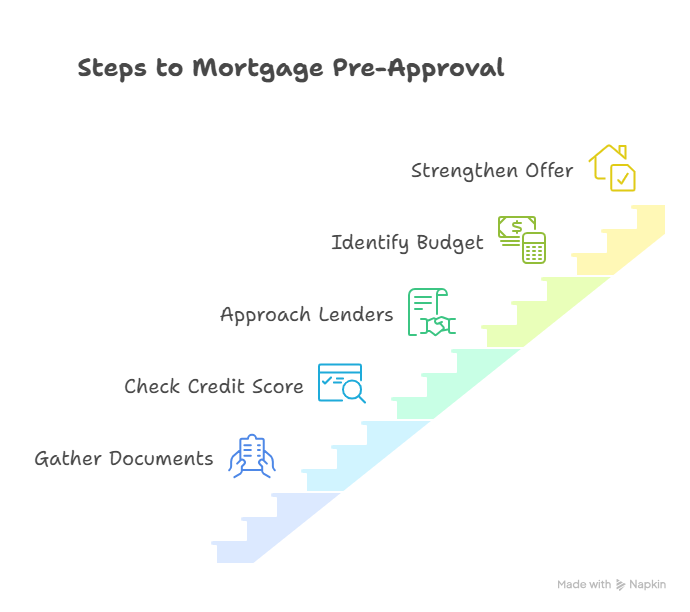

2. Skipping Mortgage Pre-Approval

- Mistake: Shopping for homes without knowing how much you can borrow.

- Solution: Get pre-approved before starting your search. This shows sellers you’re serious and helps you set a realistic budget.

3. Not Comparing Multiple Lenders

- Mistake: Accepting the first mortgage offer.

- Solution: Always shop around. Even a small difference in rates can save you thousands over time.

4. Ignoring Additional Costs

- Mistake: Budgeting only for the down payment.

- Solution: Don’t forget about closing costs, property taxes, insurance, and HOA fees. Use our Mortgage Calculator

- to estimate full monthly payments.

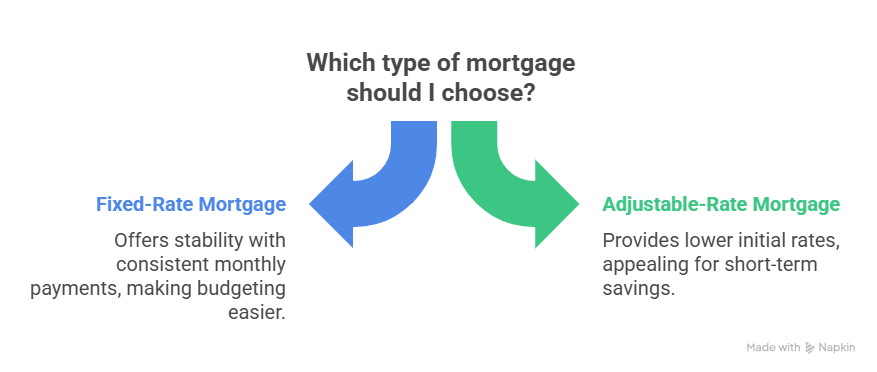

5. Choosing the Wrong Mortgage Type

- Mistake: Not understanding the difference between fixed-rate and adjustable-rate mortgages.

- Solution: Learn the pros and cons of each before deciding. Read our guide on Fixed vs Adjustable-Rate Mortgages

- .

6. Borrowing More Than You Can Afford

- Mistake: Letting lenders decide your budget.

- Solution: Stick to a payment that fits your lifestyle, not just what you’re approved for. A rule of thumb: housing costs shouldn’t exceed 28% of your gross monthly income.

7. Making Large Purchases Before Closing

- Mistake: Buying a car, furniture, or running up credit cards before closing.

- Solution: Wait until after the mortgage closes. Big purchases can hurt your credit and debt-to-income ratio.

8. Forgetting to Save for Closing Costs

- Mistake: Focusing only on the down payment.

- Solution: Closing costs usually range from 2–5% of the home price. Budget for them early.

9. Not Reading the Fine Print

- Mistake: Ignoring details in your loan agreement.

- Solution: Ask questions about interest rate adjustments, prepayment penalties, and lender fees.

10. Rushing the Process

- Mistake: Feeling pressured to buy quickly.

- Solution: Take your time, research options, and use online tools like USA Mortgage Tools

- to plan carefully.

Expert Tips to Stay Ahead

- Start improving your finances at least a year before buying.

- Use multiple online calculators to compare scenarios.

- Always keep an emergency fund even after closing.

Conclusion

Buying your first home in the USA doesn’t have to be stressful—if you avoid these common mistakes. By preparing early, comparing lenders, and using the right tools, you’ll be well on your way to making a smart, affordable decision.

👉 Start today by trying our Free Mortgage Calculator

to see how much home you can afford.

Ready to Calculate Your Mortgage?

Use our free mortgage calculator to estimate your monthly payments and see what you can afford.

Calculate Now