Step-by-Step Guide to Getting Pre-Approved for a Mortgage in the USA

Calculate Your Mortgage Now

Get instant estimates for your monthly payments

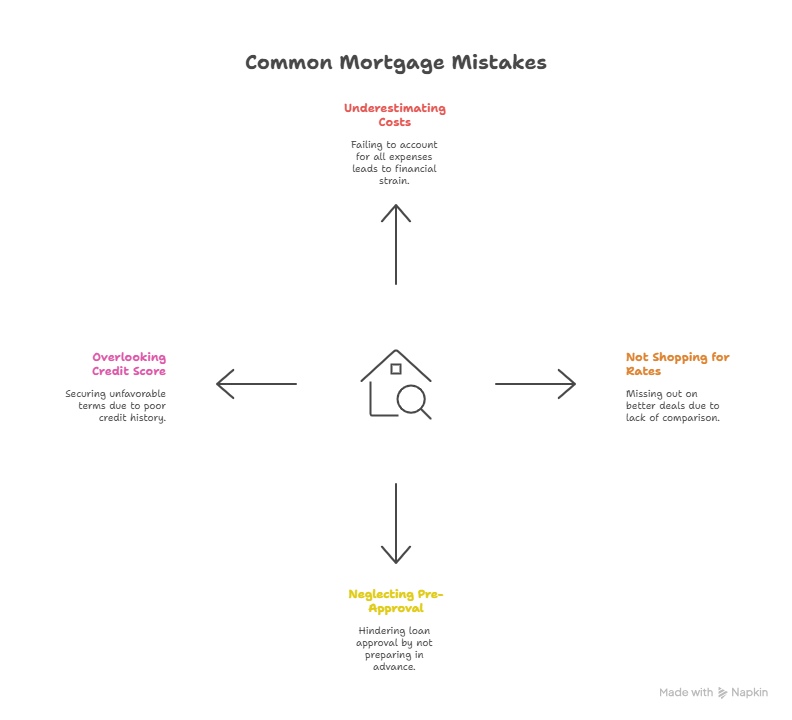

Buying a home in the USA can be an exciting but overwhelming process—especially for first-time buyers. One of the smartest steps you can take early on is getting pre-approved for a mortgage. Pre-approval not only gives you a clear idea of your budget but also makes you a stronger buyer in the eyes of sellers.

In this guide, we’ll walk you through everything you need to know about mortgage pre-approval in the USA, including requirements, documents needed, and expert tips to increase your chances of success.

What is Mortgage Pre-Approval?

Mortgage pre-approval is a process where a lender reviews your financial details—such as income, credit score, debts, and assets—to determine how much they’re willing to lend you. Unlike pre-qualification (which is a simple estimate), pre-approval involves a more detailed check and gives you an official letter stating your approved loan amount.

👉 Why it matters: Sellers see pre-approved buyers as serious and financially prepared, which can make your offer more attractive.

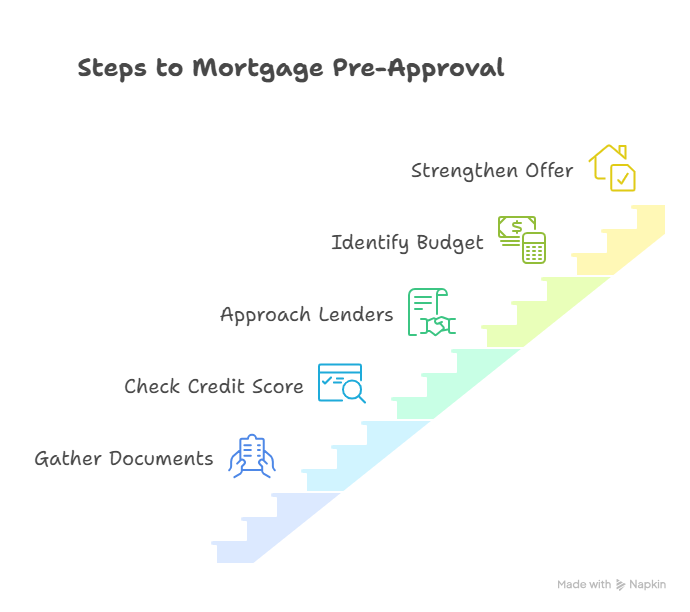

Step 1: Check Your Credit Score

Your credit score plays a big role in mortgage approval. In the USA, most lenders require a minimum FICO score of 620, though higher scores (700+) can help you secure better interest rates.

Tips to improve your credit score before applying:

- Pay down credit card balances.

- Avoid applying for new loans or credit cards.

- Dispute errors on your credit report.

- Make sure bills are paid on time.

👉 You can read our guide: How to Improve Your Credit Score Before Applying for a Mortgage

Step 2: Gather Required Documents

Before applying for pre-approval, gather all the documents your lender will request. This shows you’re organized and speeds up the process.

Common documents include:

- Proof of income (pay stubs, W-2 forms, tax returns)

- Employment verification

- Bank statements (checking, savings, investments)

- Proof of assets (retirement accounts, stocks)

- Identification (driver’s license, Social Security number)

- Debt details (credit cards, car loans, student loans)

Step 3: Determine How Much You Can Afford

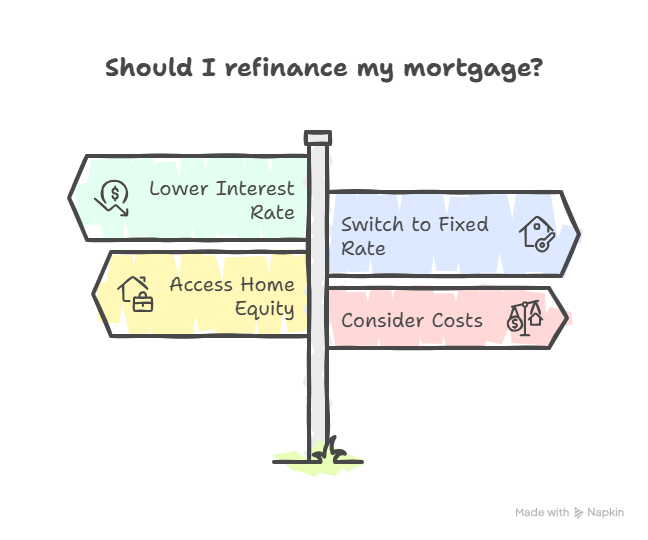

Getting pre-approved doesn’t mean you should borrow the maximum amount offered. Take time to assess your comfort zone for monthly payments.

👉 Use our free tool: Mortgage Calculator

to estimate your monthly payments, interest, and loan terms.

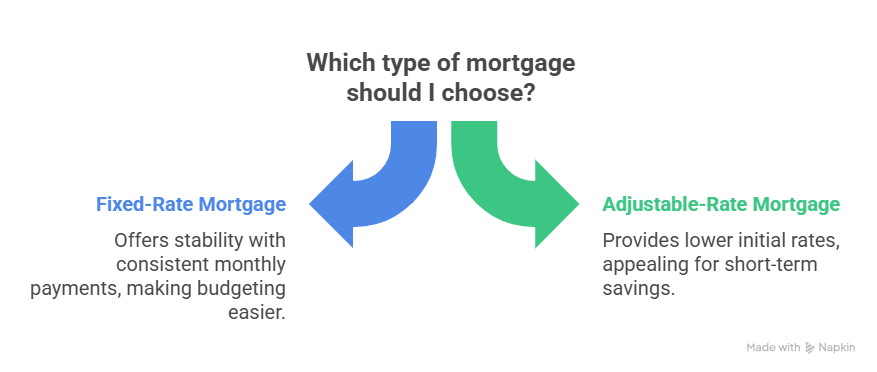

Step 4: Shop Around for Lenders

Different lenders offer different rates, fees, and terms. Don’t just stick to one bank—explore multiple options.

Types of lenders to consider:

- Traditional banks

- Credit unions

- Online mortgage lenders

- Mortgage brokers

Pro Tip: Even a small difference in interest rates can save you thousands of dollars over the life of your loan.

Step 5: Submit Your Application

Once you’ve chosen a lender, complete the mortgage pre-approval application. The lender will review your financial information, run a credit check, and provide you with a pre-approval letter.

👉 How long does it take?

- Usually 3–10 business days.

- Valid for 60–90 days.

Step 6: Get Your Pre-Approval Letter

Your pre-approval letter states the maximum amount you can borrow and gives you credibility when making offers. Real estate agents often ask for this before showing serious properties.

Why it’s important:

- Shows sellers you’re financially ready.

- Helps narrow your home search.

- Increases negotiation power.

Step 7: Keep Your Finances Stable

After pre-approval, avoid making big financial changes until you close on your home. Lenders may re-check your financials before final approval.

Things to avoid:

- Don’t take on new debt.

- Don’t switch jobs suddenly.

- Don’t make large unexplained deposits.

Benefits of Getting Pre-Approved for a Mortgage

- Clarity on budget: Know exactly how much home you can afford.

- Confidence in negotiations: Sellers prefer buyers with pre-approval.

- Faster closing process: Since your finances are already verified.

- Better financial planning: Helps you compare mortgage options wisely.

Final Thoughts

Getting pre-approved for a mortgage in the USA is a vital first step in your home-buying journey. By checking your credit score, gathering documents, comparing lenders, and staying financially stable, you’ll not only strengthen your chances of loan approval but also gain confidence while house hunting.

Remember, pre-approval is not the same as final loan approval, but it’s a powerful tool that sets you apart in a competitive housing market.

👉 Start by trying our Mortgage Calculator

today and take the first step toward owning your dream home.

Ready to Calculate Your Mortgage?

Use our free mortgage calculator to estimate your monthly payments and see what you can afford.

Calculate Now