Fixed vs Adjustable-Rate Mortgages: Which is Better for First-Time Buyers?

Calculate Your Mortgage Now

Get instant estimates for your monthly payments

Introduction

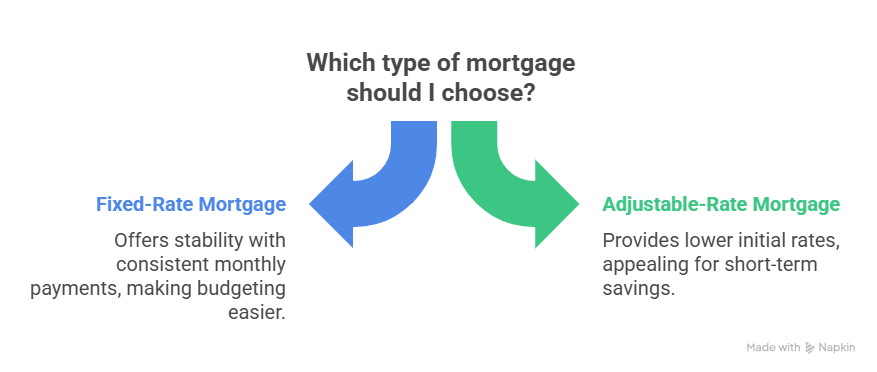

Buying your first home in the USA is exciting, but one of the toughest decisions you’ll face is choosing between a fixed-rate mortgage (FRM) and an adjustable-rate mortgage (ARM). Both have advantages and disadvantages, and the right choice depends on your financial goals, risk tolerance, and how long you plan to stay in the home.

This guide explains the difference, highlights the pros and cons, and helps you decide which option is better for first-time buyers.

What is a Fixed-Rate Mortgage?

A fixed-rate mortgage is a loan where the interest rate remains the same for the entire term.

- Common terms: 15, 20, or 30 years.

- Monthly payments: Stay consistent over time.

Pros:

- Predictable monthly payments

- Easier to budget long-term

- Protection from interest rate hikes

Cons:

- Higher starting interest rates compared to ARMs

- Less flexibility if you plan to move soon

What is an Adjustable-Rate Mortgage (ARM)?

An adjustable-rate mortgage (ARM) has a fixed interest rate for an initial period (often 3, 5, 7, or 10 years). After that, the rate adjusts annually based on market conditions.

Pros:

- Lower initial interest rate (more affordable at first)

- Good for buyers who don’t plan to stay in the home long

- Potential savings if interest rates drop

Cons:

- Uncertainty after the fixed period ends

- Payments can increase significantly

- Harder to budget long-term

Fixed vs. ARM: A Side-by-Side Comparison

FeatureFixed-Rate MortgageAdjustable-Rate MortgageInterest RateStays the sameStarts low, changes laterBest ForLong-term homeownersShort-term homeownersMonthly PaymentPredictableCan change after fixed periodRisk LevelLowModerate to high

Which is Better for First-Time Buyers in the USA?

It depends on your situation:

- Choose Fixed-Rate Mortgage if:

- You want stability and predictable payments.

- You plan to live in the home for 10+ years.

- You want protection against rising interest rates.

- Choose Adjustable-Rate Mortgage if:

- You plan to sell or refinance within 5–7 years.

- You want lower initial payments.

- You are comfortable with some financial risk.

Real-Life Example

Imagine buying a $300,000 home with 20% down ($60,000).

- 30-Year Fixed-Rate Mortgage (6.5%)

- Monthly Payment: ~$1,518 (excluding taxes/insurance)

- Predictable for the entire loan term.

- 5/1 ARM (Initial 5 Years at 5.5%)

- Monthly Payment First 5 Years: ~$1,362

- After 5 years, payment could increase if rates go up.

👉 For buyers planning to stay short-term, the ARM saves ~$156 per month at first. But for long-term buyers, the fixed-rate option provides peace of mind.

Expert Tips for First-Time Buyers

- Use a mortgage calculator before deciding. Try our free USA Mortgage Tools Calculator

- to compare scenarios.

- Always consider how long you plan to stay in the home.

- Ask lenders about rate caps on ARMs (the maximum your rate can increase).

- Don’t just focus on today’s rates—plan for the future.

Conclusion

There’s no one-size-fits-all answer. For first-time buyers who value stability, a fixed-rate mortgage is usually the safer choice. However, if you’re confident you’ll move or refinance within a few years, an ARM could save you money initially.

The key is to run the numbers, weigh your risk tolerance, and plan ahead. Start by trying out our free mortgage calculator

to see how different loan options affect your monthly payments.

Ready to Calculate Your Mortgage?

Use our free mortgage calculator to estimate your monthly payments and see what you can afford.

Calculate Now